How To Get The Highest Appraisal Value

Doing just 10% more will make all the difference.

Appraisals are possibly one of the most important aspects of real estate investing, particularly when trying to scale or grow your portfolio using the Volition “Multiplier Effect”. They don’t happen often, but when they do, It’s critical that you give them the time and due diligence they deserve. An appraisal can literally make or break your business model.

When are appraisals important? Obviously, you’ll need an appraisal when you are acquiring a new property. Most of us who have bought a property have gone through an appraisal, whether or not you were directly involved. Oftentimes, your mortgage broker or lender will order an appraisal and it will happen seamlessly behind the scenes. It’s not usually a problem… unless the appraisal comes in light.

But appraisals are key in the refinancing of your property as well. Once you have equity established in your property (whether through capital appreciation over time, force equity lift through renovations, change of use, creation of value, etc.), one of the most common ways to access that equity is through a refinance. This can include a complete payout of your existing mortgage, a top-up of your existing mortgage, or placing a HELOC on your property in addition to your existing mortgage.

Generally speaking, the higher the appraisal, the better. A higher appraisal will allow you to get MORE equity out of your property, which means more cash in hand… cash that is typically used by real estate investors to go buy another property. Basically, one property turns into two. Done right, you should be able to accomplish this every 3-4 years. This is what Volition has coined the “Multiplier Effect”. And this is how Volition investors have been able to scale their portfolio from 1 to 2, to 4, to 8 or more properties in Toronto.

With this in mind, let’s learn how to get the absolute highest appraised value for your property.

You can approach appraisals in one of two ways: you can take a passive approach like everyone else, or you can take an active approach which is how Volition investors do it. In the passive approach, you leave it to the fates to determine your value. In the active approach, you try to influence the appraised value as much as possible.

At Volition, we pride ourselves on finding and working with the absolute best service providers in the industry. The best mortgage brokers, the best accountant, the best lawyer, etc. Funny enough… appraisers are the ONE time that we don’t mind working with an incompetent and lazy service provider. Let me tell you why.

Volition recommends that you put in the extra 10% effort. That extra 10% effort is what can make all the difference in the world. Most people don’t put in that effort. So when you do put in that effort, you can impress the hell out of the appraiser, make their job easier, and make it more likely that they will just go with whatever you have provided them.

What we do is we create an Appraisal Package for the appraiser. So when the appraiser comes on-site, I hand them a well-developed, well-considered, well-thought through set of documents for them to look at. This will quickly give the appraiser an idea of the property, an idea of the neighbourhood, sample comparables, and why it’s reasonable for your property to be worth $2.1M (or whatever your target value is).

You have to remember: appraisers appraise properties ALL OVER THE CITY. It’s impossible for them to be absolute experts for every property they appraise, since they have to do upwards of 8-10 properties A DAY! You want to quickly establish yourself as an expert and knowledgeable, without being overbearing and/or condescending. You want to work WITH the appraiser and their ego and not overstep your bounds, but at the same time make their job easy. Soft communication and interpersonal skills are a must.

One of the most common questions that the Volition team gets in our Exclusive Whatsapp Mastermind Chat is “if I do xyz upgrade (mini-split AC system, marble instead of quartz, etc, etc, etc.), will I get a higher appraisal”. Our answer is “That’s not how appraisals work”.

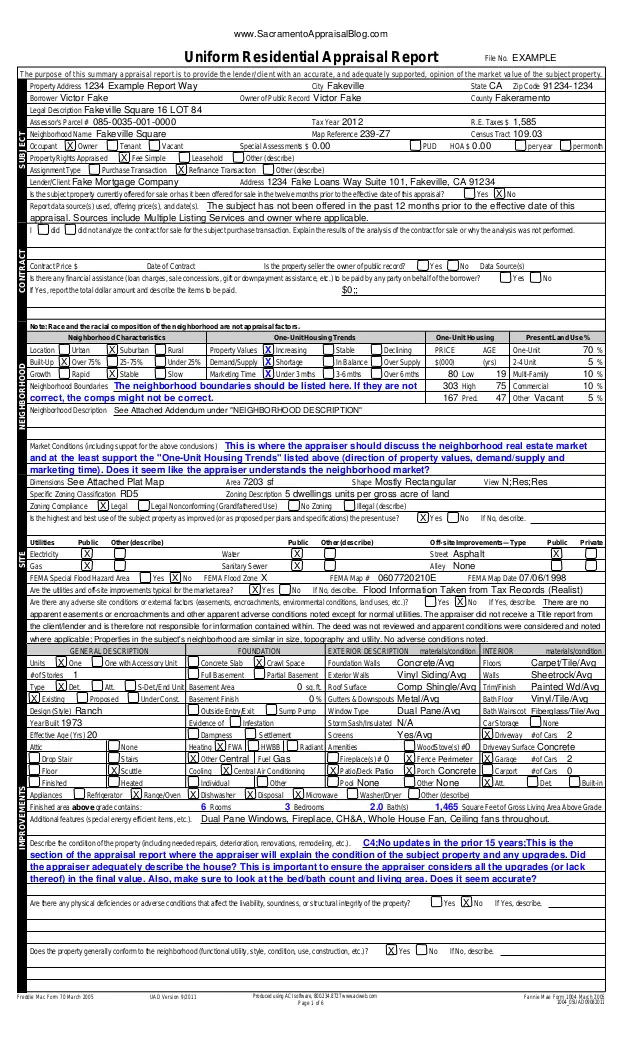

The best way to understand this is to actually obtain and STUDY an appraisal report. You’ll then see EXACTLY how it is that an appraisal works, and then you can reverse engineer and work backward to provide exactly what the appraiser needs. As a Volition client, we will provide you with a sample real-life, redacted appraisal report, so you can learn more about it.

Sample Appraisal Report

Essential Components of an Appraisal Package:

1. Feature Sheet

The feature sheets we create aren’t too much different than the ones we create for listings when we are selling a property! Your goal here is to highlight the key features of the property. Appraisers will spend maybe 15-30 mins doing a quick walkthrough of the home, and when making “notes”, they are essentially going through a checklist. “Overall Condition of Property: Exceptional”. “# of bedrooms”. “# of half baths”. “# of full baths”. Etc. They don’t have the time or energy to go through and examine every nitpicky detail. They generally get “overall” impressions of a property to determine the level of property you have (i.e. is it a recently renovated property, to what quality, completely renovated or partially renovated, any major issues like slanted floors, etc) and then they use that as an input into the next stage of the appraisal process.

2. Comparables

After getting an overall impression of your property, Appraisers will then pull “comps”. Comps are properties that are comparable in size, quality, and location to the subject property. No two properties are exactly alike (unless they are in a subdivision with a single developer/builder with a cookie-cutter model, or perhaps condos), especially in downtown Toronto, so they are pulling comps that are as close as possible to your property. After pulling a number of comps, they then make ADJUSTMENTS based on distance/location, quality of finishes, size, etc. This is the key component. You want the appraiser comparing with MORE EXPENSIVE properties and adjusting downwards, rather than LESS EXPENSIVE properties and adjusting upwards. For example, if your property is in Seaton Village (west of Bathurst), you want the appraiser to be comparing (as much as reasonably possible) to Annex properties (east of Bathurst) rather than Christie Pits (west of Christie). If an appraiser didn’t know the difference and you managed to get them to compare to Annex, you could very well get $200-300k more in your appraisal!

Also, this is why your feature sheet is important. You want to be compared against those super-luxury, newly reno’d, expensive triplexes, not the beat-up triplex. Even if you only spent $200k on your reno, you want to be compared to the $500k reno. Again, appraisers GENERALLY don’t know the difference. They only know by the pictures on MLS!

As you can plainly see, their guess is basically as good as ours! It’s a HIGHLY subjective opinion, and we want to work this into our favour… and so it’s then easy to see why it’s not a bad thing to have a lazy appraiser. If we do all the work for them, then they might just use it and give us what we want (or something close to it!)

3. Summary Table

The last part is the summary table. The summary table is the nice finishing touch that pulls together the entire appraisal package. This is where Volition investors summarize the important features of the property and compare it to other like properties, to try to get the appraiser to think that your subject property is in the same realm as the comps that you have pulled for them.

For example, if your property is a 25ft wide lot, you may wish to show a comparison of lot widths to other 25ft lots. The key takeaway here is that every summary table will look a little bit different. You want to design your summary table so that it highlights your property in the best possible light. Let’s say that yours is a true 3-storey and everything else is a 2.5 storey, then maybe this is something you want to include in your summary table. However, if something that you’re trying to compare against is a little bit better than yours, then maybe you don’t actually include that in the summary table. So let’s say that yours is a 20-foot lot and you’re comparing against 25ft lots, then maybe that’s something you actually intentionally exclude from the summary table. This is also where you would put your intended estimated value for your subject property – if you’re wanting to get $1.4M, then put $1.4M. You’re really putting together a business case, and hoping that the appraiser will just say “Okay, yep, this is reasonable, I’ll use this”.

The idea here is to be smart, with the ultimate goal of influencing the appraiser to try to bring them into your line of thinking. If you do all this work FOR the appraiser, and you supply them with the comps, and you’ve done the background legwork to prove that your property is indeed comparable to those comps, then there is a possibility that they’ll just use those comps (or ones like it). Every appraiser is supposed to conduct their own independent search. But the reality is, it takes a long time and it’s a lot of effort to narrow down properties. If they even simply just use your suggestions as a starting point, it will lead to better outcomes for you.

Finale

So as you can see, this is why we don’t mind having lazy appraisers. It’s definitely not a guarantee that this will work. It’s very plausible that some appraisers will just take the entire package and throw it in the garbage. That has not been the experience for any of our Volition investors’ after having done hundreds and hundreds of appraisals using this methodology. There is also the chance of offending the appraiser with this approach, which is why we also caution positioning this as “trying to be helpful”, rather than “being annoying and coming across as a know-it-all”. It’s a delicate balance.

As a value add to our Volition clients, we coach them through this appraisal process, we provide them with a sample appraisal package that they can then customize for their own needs, and we pull comps for them to assist in them getting the HIGHEST possible appraisal valuation. Contact us if you’re interested in working with Volition (info@volitionprop.com), and getting the highest appraisal values just like our other Volition investors.